The Green Tech Venture Capital Revolution Fueling a Sustainable Future

The urgency for sustainable innovation has never been greater. Green tech venture capital is stepping up to the challenge, providing essential funding that enables groundbreaking advancements in technology aimed at preserving our planet. This financial backing is critical for startups and established companies alike as they strive to create solutions that address today’s pressing environmental challenges. As we navigate this complex landscape, it becomes clear that green tech venture capital is not just an investment vehicle; it is a fundamental driver of positive change.

The Rise of Green Tech Venture Capital Funding a Sustainable Future

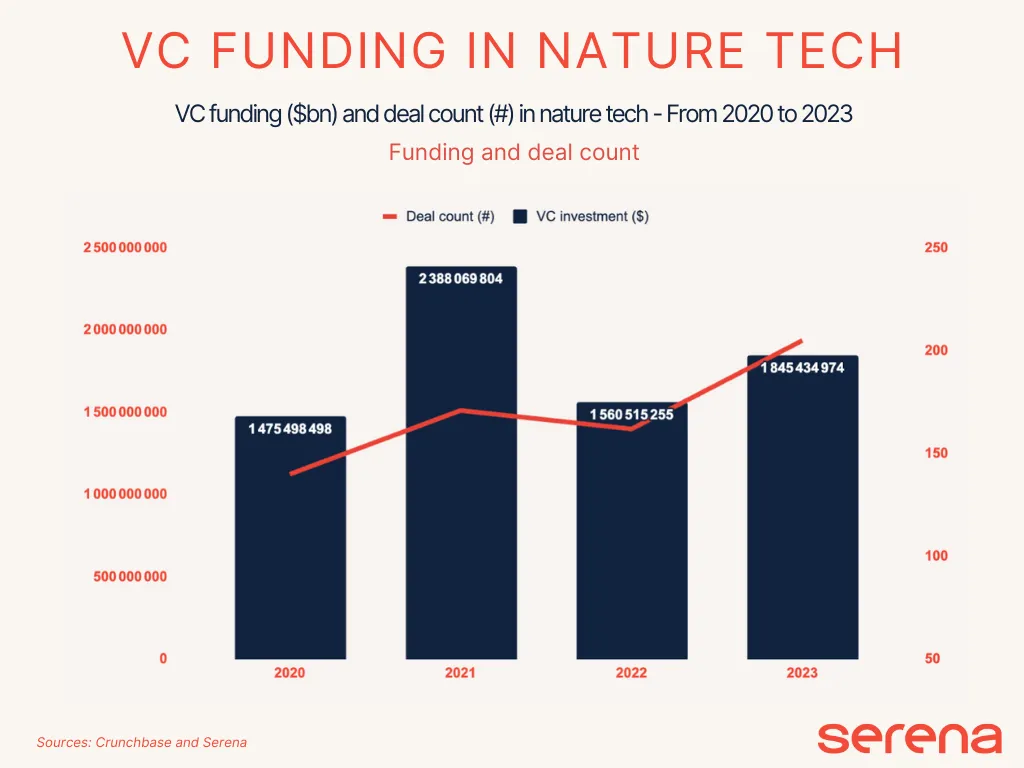

In recent years, the rise of green tech venture capital has been remarkable. This surge can be traced back to several interrelated factors that have galvanized a movement toward sustainability.

The shift towards sustainability is not merely a trend; it is a necessity driven by mounting evidence of climate degradation and resource depletion. Investors are increasingly recognizing the dual benefit of addressing climate change while also tapping into lucrative markets created by shifting consumer behaviors. With global leaders prioritizing sustainable practices through policies and regulations, venture capital has emerged as a vital lifeline for innovative companies looking to make a difference.

Climate Change Awareness

The reality of climate change is becoming harder to ignore. Extreme weather events, rising temperatures, and ecological disruptions are all alarming indicators of our warming planet.

Investors have started to see the writing on the wall: climate change poses not only moral and ethical dilemmas but also substantial financial risks. Companies that fail to adapt to a low-carbon economy risk obsolescence, while those embracing sustainability can capture significant market share.

This awareness is prompting a new generation of investors to seek opportunities in green tech, where their capital can work to mitigate these risks while generating returns.

Regulatory Pressure and Incentives

Governments globally are wielding regulatory measures to combat climate change, implementing carbon pricing mechanisms, renewable energy mandates, and incentives for greener technologies.

Such government initiatives create a favorable environment for green tech investments. They diminish the uncertainty that often surrounds emerging industries, making them more appealing to venture capitalists. When investors know that there is regulatory support for an industry, their confidence in its viability increases, leading to greater capital inflow.

Consumer Demand for Sustainability

The modern consumer is more environmentally aware than ever before. Information about products’ carbon footprints, sourcing, and overall environmental impact is readily available, and consumers are making choices aligned with their values.

As businesses pivot to meet this demand, the opportunity for green tech ventures grows exponentially. Venture capitalists are investing in companies that offer sustainable solutions in various sectors, ensuring that their portfolios align with the changing tide of consumer sentiment.

Investing in Innovation Key Trends in Green Tech Venture Capital

As green tech venture capital gains momentum, certain trends are shaping the investment landscape. Identifying these key trends is imperative for understanding how to effectively participate in and capitalize on this evolving sector.

The intersection between technological innovation and environmental sustainability is where much of the excitement lies. In pursuing growth, investors need to keep an eye on innovations that drive down costs, improve efficiency, and enhance user experience.

Increased Institutional Investor Participation

Traditionally, venture capital firms have held the lion's share of investments in startups. However, institutional investors such as pension funds and insurance companies are waking up to the potential of green tech.

These entities recognize that integrating sustainability into their portfolios not only fulfills regulatory obligations but also attracts younger, increasingly conscientious clients. This influx of institutional capital is vital; it suggests confidence in the growth and stability of the green tech sector, providing startups with the necessary resources to scale.

Rise of Impact Investing

Impact investing, which emphasizes generating measurable social and environmental benefits alongside financial returns, is gaining traction within the realm of green tech.

Venture capitalists are beginning to evaluate their investments through an impact lens, seeking out companies that deliver both profitability and tangible benefits to society and the environment. This transformative approach not only contributes to building a sustainable future but also enriches the investor community by fostering a sense of purpose.

Integration of Technology

Technological integration plays a crucial role in enhancing the effectiveness and efficiency of green tech solutions. Innovations such as artificial intelligence, machine learning, and big data analytics are at the forefront of this evolution.

These technologies enable startups to optimize operations, reduce waste, and improve performance metrics. By harnessing these advancements, green tech ventures are better equipped to compete and thrive in the marketplace, ultimately attracting more venture capital funding.

The Landscape of Green Tech Opportunities and Challenges for VCs

Despite the promising developments within the green tech sector, several challenges remain that investors must navigate carefully. Understanding these hurdles can help venture capitalists make informed decisions while maximizing opportunities.

Identifying opportunities amid challenges requires a nuanced approach, acknowledging that while the path may not always be smooth, the potential rewards are substantial.

Long-Term Investment Horizons

One of the inherent challenges of investing in green tech is the longer timeframes needed to realize returns.

Many green tech startups take years to develop their technologies and reach profitability. This extended timeline demands patient capital and a long-term investment strategy. Investors must adopt a perspective that appreciates the incremental milestones achieved along the way rather than focusing solely on immediate returns.

Regulatory Uncertainty

The regulatory framework governing green technologies can be convoluted and subject to change. New policies, amendments, and shifts in political landscapes can influence the viability of projects overnight.

Investors must conduct thorough due diligence and risk assessments before committing to any initiative. Staying ahead of regulatory changes and understanding their implications is vital for safeguarding investments and ensuring alignment with governmental policies.

Competition from Established Industries

Emerging green tech startups often face stiff competition from established companies with entrenched market positions and well-established distribution networks.

To carve out a niche, these startups must differentiate themselves through innovation and execution. A robust business strategy that highlights unique value propositions is essential for competing against legacy players who may not prioritize sustainability.

Driving Sustainability How Green Tech VC is Accelerating Clean Energy Solutions

Green tech venture capital is playing a pivotal role in accelerating clean energy solutions, transforming the energy landscape, and contributing to global efforts to decarbonize the economy.

As societal pressure builds to transition away from fossil fuels and increase reliance on renewables, the demand for innovative clean energy solutions has surged.

Renewable Energy Investments

Investment in renewable energy continues to dominate the green tech VC landscape, with venture capital flowing into solar, wind, hydro, and geothermal technologies.

Innovations in areas like energy storage, smart grids, and decentralized energy systems are attracting substantial capital. These advancements not only enhance the reliability and accessibility of renewable energy sources but also present exciting investment opportunities.

Electric Vehicles and Mobility

The transportation sector is undergoing a radical transformation, with electric vehicles (EVs) leading the charge. Concerns over air pollution, the depletion of natural resources, and climate change are driving consumers and manufacturers alike towards more sustainable mobility solutions.

VC investors are keenly focused on supporting startups developing next-generation battery technologies, EV charging infrastructure, and autonomous driving systems. This movement toward electrification represents a massive opportunity for growth and returns in the coming decades.

Advancements in Energy Efficiency

Improving energy efficiency in buildings and infrastructure remains a critical aspect of climate mitigation. Cutting-edge technologies are being developed to minimize energy consumption and enhance energy management capabilities.

Venture capital funding is channeling resources into innovations such as smart building technologies and advanced materials designed to optimize energy usage. These solutions are not just environmentally friendly; they also offer cost-saving benefits to consumers and businesses.

Beyond Solar and Wind Emerging Green Tech Sectors Attracting VC Funding

While solar and wind energy continue to receive significant attention, numerous other sectors within green tech are emerging as attractive avenues for venture capital investment.

As environmental challenges evolve, so too do the solutions that aim to address them. By exploring these less conventional areas, investors can unlock new opportunities and diversify their portfolios.

Sustainable Agriculture & Food Tech

Sustainable agriculture is becoming a focal point for innovation as food security and environmental concerns converge. Technologies focused on vertical farming, precision agriculture, alternative protein sources, and sustainable packaging are gaining traction among startups.

Venture capital is increasingly supporting these initiatives, recognizing the urgent need to rethink traditional food production models and minimize their environmental footprint. Investing in this sector means supporting a more resilient and sustainable food system.

Clean Water and Waste Management

Water scarcity and waste management are pressing global issues necessitating innovative solutions.

Startups focused on water purification, wastewater treatment, and waste-to-energy technologies are receiving increased attention from venture capitalists. These sectors present viable opportunities for investment while directly addressing essential needs in communities worldwide.

Carbon Capture and Storage

As emissions continue to rise, carbon capture and storage (CCS) technologies are gaining relevance.

Investments in CCS solutions aim to mitigate the environmental impacts of various industries, particularly power generation and heavy manufacturing. By financing startups innovating in this space, venture capitalists contribute to reducing carbon footprints and advancing technologies that hold promise for significant climate benefits.

Navigating the Green Tech Landscape Due Diligence and Investment Strategies

Navigating the green tech landscape requires a sophisticated understanding of the unique dynamics at play. Effective due diligence and investment strategies are crucial to thriving in this burgeoning sector.

By employing targeted approaches, investors can enhance their chances of success and maximize their impact on sustainability.

Conducting Robust Due Diligence

Thorough due diligence is paramount when evaluating green tech startups.

Investors should assess not only the technology but also the competitive landscape, regulatory environment, and scalability potential of each venture. Understanding the founders' backgrounds, their vision, and the team’s capabilities is equally important, as strong leadership is often a key determinant of success.

Building Strategic Partnerships

Collaboration is essential in the green tech ecosystem. Forming strategic partnerships can amplify the impact of investments and help startups navigate challenges more effectively.

Venture capitalists should consider forging alliances with established companies, research institutions, and governmental organizations. These partnerships can provide invaluable resources, knowledge-sharing opportunities, and access to markets that facilitate growth.

Engaging with Stakeholders

An inclusive approach that engages relevant stakeholders can yield valuable insights and foster goodwill. By involving consumers, local communities, and advocacy groups, investors can gain a comprehensive understanding of market needs and expectations.

Engaging stakeholders can also enhance the reputation of green tech startups, promoting positive narratives that attract further investments.

The Impact of ESG on Green Tech Venture Capital

Environmental, Social, and Governance (ESG) considerations are reshaping the investment landscape, influencing how venture capitalists evaluate potential opportunities.

Investors are increasingly scrutinizing the ESG profiles of companies, viewing them as integral components of risk assessment and long-term viability.

The Growing Importance of ESG Metrics

ESG metrics are becoming more standardized and widespread, enabling investors to assess the sustainability credentials of companies meaningfully.

A strong ESG profile can signify lower risk, improved operational efficiency, and a better capacity for long-term growth. Venture capitalists are recognizing that aligning investments with robust ESG criteria can enhance portfolio resilience.

Investor Activism

As the importance of ESG principles rises, so does investor activism. Many venture capitalists are leveraging their influence to advocate for responsible practices within the companies they invest in.

This proactive approach not only contributes to better governance and ethical behavior but can also generate positive social outcomes, further reinforcing the rationale for investing in green tech.

Enhanced Reputation and Market Differentiation

Adopting an ESG-focused investment strategy can significantly enhance a firm's reputation. Investors can distinguish themselves in a crowded marketplace by emphasizing their commitment to sustainable practices.

This differentiation can lead to improved relationships with limited partners and attract a broader range of investors interested in socially responsible investing.

Scaling Green Tech Startups Challenges and Strategies for VC-backed Growth

Scaling green tech startups presents unique challenges that require tailored strategies and support from venture capitalists.

As these companies grow, they must navigate various obstacles while staying true to their mission of driving sustainability.

Financial Constraints

Securing adequate funding is often one of the foremost challenges faced by startups in the green tech space.

Venture capitalists must be prepared to provide ongoing support as the company scales, helping to bridge the gaps that arise during growth. Offering guidance in financial management and fundraising strategy can empower startups to successfully navigate this phase.

Talent Acquisition and Retention

Attracting and retaining top talent is critical for the success of any startup, and green tech is no exception.

Investors should assist portfolio companies in creating compelling workplace cultures that align with their sustainability missions. Offering competitive compensation packages, professional development opportunities, and fostering inclusivity can position startups as desirable employers in a competitive job market.

Market Penetration Strategies

Establishing a foothold in the market requires strategic planning and execution.

Venture capitalists can lend their expertise by helping startups identify target audiences, develop go-to-market strategies, and build brand awareness. Collaborating with marketing teams and leveraging networks can accelerate market penetration and drive growth.

The Future of Green Tech Venture Capital Predictions and Potential

The outlook for green tech venture capital is exceptionally bright. As investor interest surges and the demand for sustainable solutions grows, the future holds immense potential for innovation and progress.

Recognizing the underlying trends shaping this landscape will be crucial for investors looking to maximize their impact.

Continued Investment Growth

The global focus on sustainability is likely to catalyze further investment in green tech.

As awareness of environmental issues expands, we can expect more capital flowing into this space. As institutional investors increasingly allocate funds to green initiatives, the total investment volume in green tech is set to climb, bolstering the pipeline of innovative projects.

Technological Evolution

The pace of technological advancement will continue to shape the future of green tech venture capital.

Breakthroughs in clean energy, efficient resource utilization, and smart technologies will redefine what is possible within the sector. Venture capitalists will play a pivotal role by supporting startups that push the boundaries of innovation and drive transformative change.

Collaborative Ecosystem Development

A collaborative ecosystem will emerge, drawing together entrepreneurs, investors, governments, and academia to tackle pressing environmental challenges collectively.

Through partnerships and shared goals, stakeholders across the spectrum can pool resources and expertise to create scalable solutions. Venture capitalists will be instrumental in fostering these alliances, unlocking new avenues for growth and impact.

Green Tech and the Global Economy The Role of Venture Capital in Sustainable Development

The relationship between green tech venture capital and sustainable development is symbiotic.

As venture capital empowers innovative startups to address environmental challenges, it simultaneously contributes to economic growth and job creation.

Job Creation and Economic Resilience

Green tech creates numerous job opportunities across various sectors, including renewable energy, sustainability consulting, and clean transportation.

By nurturing startups through venture capital investments, economies can enhance their resilience while transitioning to low-carbon futures. This dual benefit reinforces the case for investing in green technologies, showcasing their potential to drive economic prosperity alongside environmental stewardship.

Strengthening Supply Chains

As green tech solutions proliferate, supply chains will adapt to incorporate sustainable practices.

Venture capitalists can support startups developing circular economy solutions that minimize waste and maximize resource efficiency. By engaging with supply chain partners, investors can help drive holistic change throughout entire sectors, amplifying the positive impact of their investments.

Influencing Policy and Regulation

The growth of green tech venture capital can also influence policy and regulation. As successful startups demonstrate the viability of sustainable solutions, policymakers may respond by implementing supportive frameworks that encourage further innovation.

This interplay between venture capital and public policy can create an enabling environment for green tech, accelerating the transition to a sustainable economy.

Conclusion

In conclusion, green tech venture capital is at the forefront of fueling a sustainable future. By providing the essential financial backing for innovative technologies and solutions, VCs play a critical role in addressing the global climate crisis. Despite challenges, the opportunities within this sector are vast and varied.

As we move forward, the convergence of growing investor interest, policy support, technological advancements, and consumer demand will likely propel the growth of green tech venture capital even further. Through collaboration, foresight, and a commitment to sustainability, we can look forward to a cleaner, more resilient future for our planet.